How the art market performs when stock markets slump

Some research has found that the art market isn't correlated to the equity markets, but there's a caveat to that.

Welcome to the next and very belated edition of the Priceless newsletter. If you’ve been wondering when the next installment would show up, thanks for standing by!

Here we are at the end of August, when the S&P 500 is down nearly 17% this year to date, the war in Ukraine is about to enter its seventh month, US Federal Reserve Chair Jerome Powell has suggested that interest rates will continue to rise to control inflation, and there’s still a possibility we could be heading for a recession.

Amid all this uncertainty, investors are being encouraged to buy real assets, including art, as a secure store of value.

“Certainly in a volatile geopolitical context, works of art are also a safe haven asset,” Marc Porter, Chairman of Christie’s Americas, said in an interview with Barron’s last week, when the auction house announced it will be selling the art collection of Microsoft co-founder Paul Allen this November. “It may be [that] the stock market decline points in one direction, but these mitigating factors point in another,” Porter added. “It’s one of the reasons we’ve seen such consistently high prices.”

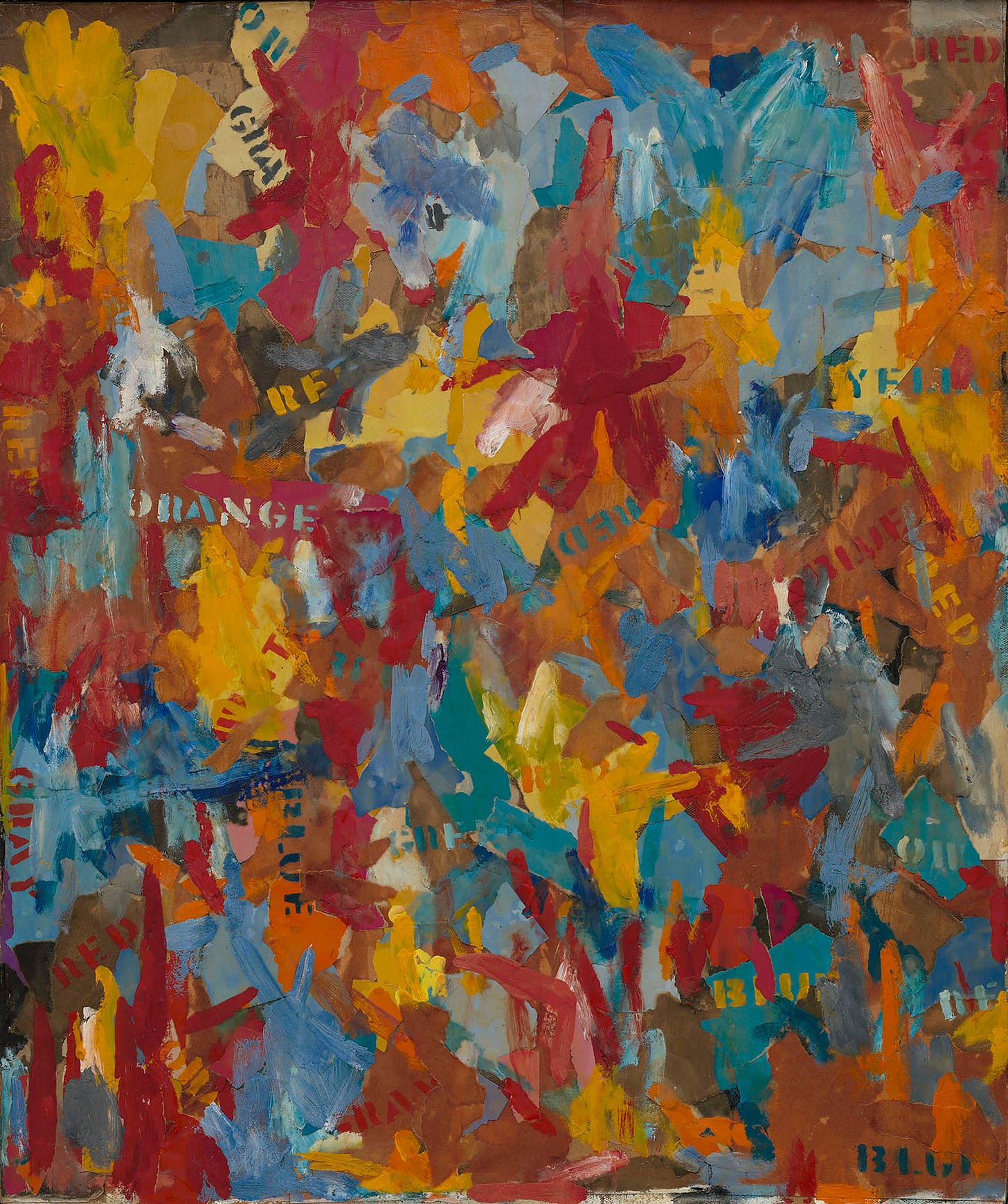

Small False Starts, by Jasper Johns, one of the paintings from the Paul Allen collection, is expected to sell for more than $50 million at Christie’s this November. Credit: Courtesy of the Paul G. Allen Estate, via Christie’s.

Is art an uncorrelated investment, where stock market declines point in one direction and the art market points in the other? In previous editions of this newsletter, I’ve written about the fact that the art market is a small, illiquid and opaque market of unique artworks, where prices are driven by subjective factors. This can certainly make it behave differently to equities.

A number of academic studies have found very low or negative correlations between art and the public equity markets. A 2013 study by Arthur Korteweg, Roman Kräussl and Patrick Verwijmeren found that correlation between art and US stock returns was around 0.09 on art sold between 1972 and 2010, while a 2012 study by Luc Renneboog and Christophe Spaenjers found that the correlation between art and the S&P 500 index for art sold between 1957 and 2007 was -0.03.

A delayed impact

However, this picture is complicated by the fact that significant art market slumps have followed close on the heels of major stock market corrections. In 2009, for example, a year after the 2008 financial market crash, global sales of art and antiques at auction houses and dealers fell to $35.9 billion, a drop of 36% over the previous year, according the Art Basel and UBS Global Art Market report.

This time lag probably occurs because the very top end of the fine art market accounts for a disproportionately large share of the dollar value of art sales, as I’ve written before, and this top end is propped up by high net worth art buyers and sellers who are less affected by economic woes.

That means that record-breaking art sales can occur even in the most apocalyptic of times, making the art market look like a safe port in any storm. On September 15 2008, for example, the same day that Lehman Brothers announced it was going bankrupt, triggering mass panic, a stock market meltdown and the beginning of the financial crisis, Sotheby’s hosted the first sale of a glitzy two-day auction of art by Damien Hirst in London, where buyers competed for recession-proof staples such as cabinets full of diamonds and zebras incased in formaldehyde.

“We’re still appealing to a small percentage of the world’s population,” Oliver Barker, Sotheby’s then head of contemporary art in London, told the New York Times at the time. “These people are sophisticated and they still have budgets for art.” In the end, the two-day auction raised £111 million and set a new record for a single-artist auction.

However, corrections to the art market also tend to lag other markets because the art market is both small and illiquid, which means that sellers cannot offload very expensive artworks in a hurry even if they want to. The consignment process for selling a multi-million dollar artwork at auction, for example, can take months or even years and relies on coming to market when there will be the biggest pool of buyers interested in that one particular work.

Is another art market correction coming?

These two, seemingly conflicting dynamics seem to be playing out in the market right now. Following a pandemic-related slump in 2020, which was the art market’s biggest dip since 2009, last year was the third best year for art sales on record, with aggregate sales by dealers and auction houses reaching an estimated $65.1 billion in 2021, according to Art Basel and UBS.

What’s more, despite the current global economic uncertainty, there have been even more big-ticket art sales this year than there were in 2021. According to MutualArt, 104 artworks sold for over $10 million at auction during the first seven months of 2022, compared to 90 during the same period in 2021. In the Barron’s article, Christie’s Marc Porter attributed some of the art market’s current strength to “the growing wealth of our richest clients, who are the most active participants in the market” and the upcoming sale of Paul Allen’s art collection at Christie’s, which has an estimated value of $1 billion, certainly suggests that there are still plenty of willing buyers with deep pockets.

However, behind the scenes, current sentiment in the art market is telling a different story, suggesting that a downturn could be coming. ArtTactic’s July Art Market Confidence Indicator, which the company publishes twice a year after surveying art collectors, art advisors and other art professionals, fell from 75 in February 2022 to 42 in July 2022. Higher inflation, stagnant growth and geopolitical uncertainty all negatively impacted the Indicator’s economic component and “despite record auction results in 1st half of 2022, the latest ArtTactic Art Market Confidence Survey signals that the mood could be changing as we are heading into the autumn season.”

The best performing artists are less affected

If there is another art market correction, art by the most sought after artists is likely to be less affected than the rest of the market. As the graph below shows, the Artprice100 index, which tracks the 100 best performing artists in the auction market, such as Pablo Picasso, Jean-Michel Basquiat and Andy Warhol, didn’t fall as far as the S&P 500 following the 2008 financial crisis and also recovered more quickly. In 2021, the Artprice 100 index gained an impressive 36%.

But, as I’ve mentioned before, replicating the performance of this sort of index is very difficult. There’s no such thing as an art index fund and it would be almost impossible to construct a portfolio of art that includes the 100 most successful artists at auction, even if you had the money. That’s important, because beyond the most sought after 100 artists, the art market didn’t fare so well after 2008. The Global Artprice Index, which tracks the broader market of art that appears at auction, fell over 37% between the end of 2007 and the first quarter of 2009.

Fast forward to today, and the Global Artprice index, which dropped 1% over the course of last year, was already down 13.8% in the first half of this year, which suggests that the art market as a whole is weakening.

The good news is that pretty much everyone owns art for longer than one stock market cycle, and for many more compelling reasons than just its financial performance. Still, it’s worth thinking about all this if you’re considering diversifying your portfolio with art right now.

In the next newsletter, I’m going be taking a look at the contemporary and ultra- contemporary art market, which accounts for a growing share of the value and volume of art sales and performs quite differently from the rest of the art market – there’s also a little taste of that in the news snippets below.

In the meantime, this newsletter is free, and a labor of love, not of money, so I’d be delighted if you could subscribe, if you haven’t already, and share it with others who might be interested. I’d also love your feedback on what you’d like me to cover in future editions. I really want to make this as useful and as interesting as possible for subscribers, so please get in touch! Finally, if you’d like to make a small donation to support my work, I’d be very grateful, and you can do so through buymeacoffee.com. Just click on the button below. Thank you and thanks for reading!

Until next time, I’ll leave you with my top art investment news picks below. Happy Fall to you all!

If you thought that the ‘let’s burn some art’ stage of the NFT revolution was behind us, Damien Hirst is in the news again set you straight. In July 2021, Hirst put 10,000 unique NFTs up for sale, each a digital version of a physical dot painting that he made in 2016. Buyers had one year to decide whether to keep the NFT or the physical painting associated with it. This month, Hirst announced that 5,149 buyers voted to keep the physical paintings and 4851 voted for the NFTs, with Hirst increasing the NFT vote by deciding to keep the 1000 NFTs he still owns from the project in their digital form. “I have been all over the fucking shop with my decision making, trying to work out what I should do”, he said on Twitter. In September, he’s going to start burning the 4,851 physical dot paintings that were sacrificed by people who opted for the NFTs and hold a massive bonfire of the rest at Frieze week in October.

In July, Christie’s announced that it was starting its own in-house venture capital fund, Christie’s Ventures, to provide seed funding to new tech companies that could improve the art market and make it easier for collectors to view, buy and sell art.

The auction market for young artists has been growing particularly rapidly over the last two years, as younger collectors seek out fresh new talent. Artprice has just published a list of the top 10 personal auction records for artists under 40 in the first half of 2022:

1. Avery Singer (1987): $5,253,000 6. Robert Nava (1985): $639,401

2. Christina Quarles (1985): $4,527,000 7. Issy Wood (1993): $588,042

3. Jennifer Packer (1984): $2,349,000 8. Lauren Quin (1992): $588,042

4. María Berrio (1982): $1,562,500 9. Louis Fratino (1993): $365,400

5. Robbie Barrat (1999): $841,317 10. Jordy Kerwick (1982): $277,200

It’s great to see a young artists getting more attention, but it’s also worth noting prices for ultra contemporary art at auction tend to be particularly volatile, especially when artworks command high prices at auction before the artist in question has been shown in a museum, or even had a solo gallery show.

Great insights - looking forward to understanding more about the (ultra) contemporary art market - personally, I think the hike in electricity bills is going to kill the demand for permanently-on looping video installations in people's houses ;-)