Thanks for checking out the very first edition of the Priceless newsletter! Let me tell you a little bit about why I’ve started it.

I’ve been a journalist for over 20 years, writing about art and finance and the art market in particular. For eight of those years, I’ve been writing the Priceless blog, a warts-and-all guide to art investment for Forbes.

I started that blog because too much press coverage at the time suggested that investing in art was a pretty straightforward, data-driven, transparent business. In reality, art buyers were grappling with an illiquid, opaque and unregulated art market. Buying art for love was much easier, when there was no expectation that the object of your affection would pay you back, but buying art as an investment was extremely hard.

With the proliferation of businesses all claiming to democratize the art market today, there’s even more coverage that makes art investing seem simple. The huge surge of interest in NFTs (or non-fungible tokens) in recent weeks is based on the still largely untested promise that NFTs will make the art market more transparent because the chain of ownership is clear; more efficient because payment is instant; and more democratic, because they can be minted and bought on platforms outside traditional art-buying channels.

There have certainly been structural shifts during the pandemic that have made the art market more accessible. Online art sales doubled in value in 2020, according to the 2021 Art Basel and UBS art market report published last week, and now make up 25% of the market. That development, in turn, has encouraged galleries and dealers to be more transparent about prices. At the same time, a bigger market for digital art, including NFTs and augmented and virtual reality works, is beginning to develop.

The bottom line, though, is that for all its improvements around the edges, the art market is still mostly illiquid, mostly opaque and mostly unregulated. Art investment is still hard, and in some ways getting harder, because financial value in the art market is now concentrated around a small number of high priced art works like $92 million Botticellis and $69 million Beeples, which are produced by an increasingly small pool of artists.

According to the Art Basel and UBS report, only 1% of artworks fetched over $1 million at auction in 2020, but they accounted for 54% of the value of global auction sales. In the $4.7 billion post-war and contemporary art category, just 20 artists made up 48% of the value of all sales at auction.

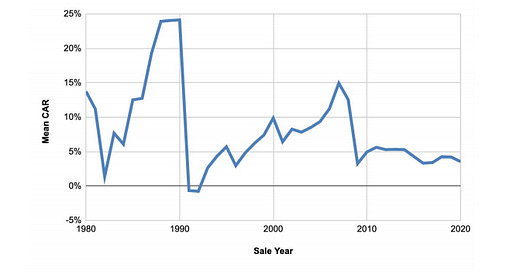

Sales data do not mean much without also knowing whether the seller made a profit, but take a look the graph below from art valuation company ARTBnk’s Repeat Sale Database. By tracking repeat sales of the same artwork at auction, it’s possible to work out the compound annual return on investment for that work.

This graph shows that the mean compound annual return (CAR) for all repeat sales in the ARTBnk database has been trending down over the last decade and was 3.12% in 2020.

Mean compound annual returns (CAR) for repeat sales by sale year

Source: Owner Expectations and Art Market Financial Performance, October 2020, Created for ARTBnk by Jianping Mei and Michael Moses of Art Market Consultancy.

However, the table below shows that within those repeat sales, works by the artists that appear the most frequently at auction had the highest returns. (A big thank you to Michael Moses, co-founder of Art Market Consultancy and a corporate strategy consultant to ARTBnk, for running the numbers for me).

Of the 7,500 artists in the database, there are just 170 ‘active’ artists, such as Picasso, Warhol and Basquiat, where there have been at least 50 repeat sales at auction, and 610 ‘periodic’ artists, such as Rembrandt and Rothko, where there have been between 10 and 50 repeat sales. Those two categories not only produce the highest returns, but make up about 90% of the database’s dollar sales volume. This may be one reason why Jean-Michel Basquiat’s 1982 Warrior sold at Christie’s for $41.4 million this week, despite appearing at auction four times in the last 16 years.

Compound annual returns based on artist frequency in the market

Clearly, how often an artist’s work appears at auction is not the only driver of financial performance. Nor are artworks created by the small group of artists currently favored by the market the only ones that can appreciate. What is true, though, is that a lot of the market’s financial value is concentrated around a pretty small number of artists, which makes it hard to determine whether the vast majority of art will go up in value at all.

That means replicating the performance of the different art indices that are available today is also tricky. Art indices are all based on public auction sales, where a lot of these high value artworks are bought and sold, but track sales of unique artworks that are now owned by other people. You can’t buy an art exchange traded fund or art index fund for this reason. Art indices are a useful guide, but they are really just a starting point for your own research, and objective analysis about art investment is still pretty hard to find.

That’s why I’m replacing my Priceless blog with this quarterly newsletter, where I can write more comprehensive, no-nonsense art investment articles, together with a news digest, to help art buyers navigate this still opaque, illiquid, unregulated market.

I hope you’ll find the Priceless newsletter interesting and useful and I’d love your feedback on what you’d like me to cover in future issues. I’d obviously be delighted if you subscribe to get it in your inbox each quarter and share it with others. It’s free and I promise not to spam you in the meantime! Finally, if you’d like to make a small donation to support my work, I’d be very grateful, and you can do so through buymeacoffee.com. Just click on the button below. Thank you and thanks for reading!